GRAND RAPIDS, Mich. — For the second time this year, and only the second time at all since 2018, the Federal Reserve will raise interest rates in the U.S.

The cascading effect could — or already has — affect mortgages, credit card and car payments, and student loan debt.

Any money borrowed from federal entities, like banks, are susceptible to fluctuating interest rates and no one stands to see the impacts more than home buyers.

“That interest rate could really push them into a different price point,” said Ashley Dietch-Schaefer, a real estate agent with Hello Homes GR. “One percent interest is substantial to most buyers. That could be the difference between $50, $100, $150-a-month difference in payment, so that’s not something to take lightly.”

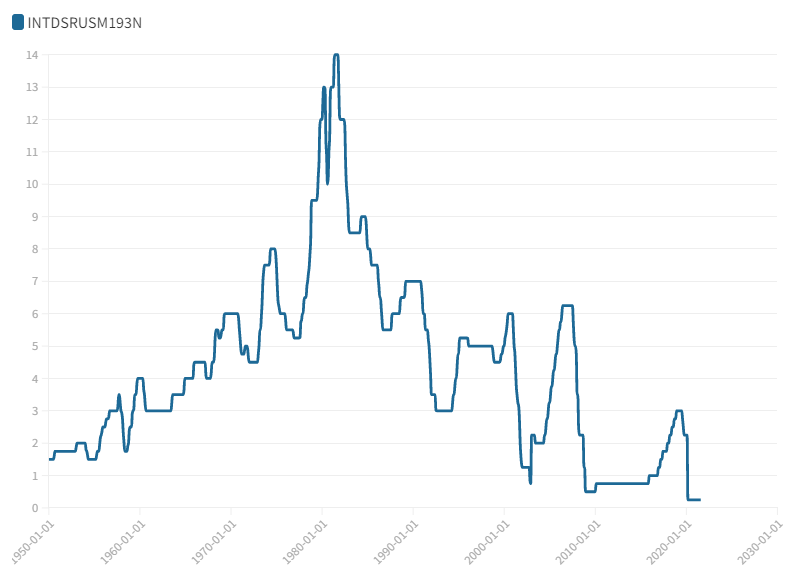

In March, the Fed raised rates by a quarter of a percent and raised them again on Wednesday by another half point. The move is to combat a 40-year-high inflation rate by cooling off the market and allowing supply to meet demand in many sectors, including housing.

It’s one of six slated hikes in 2022 set forth by the Fed.

“Inflation remains elevated, reflecting supply-and-demand imbalances related to the pandemic, higher energy prices, and broader price pressures,” said a release Wednesday from the Federal Open Market Committee, the Fed body that sets interest rates. “The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2-percent objective and the labor market to remain strong.”

For buyers, it’s less about the semantics and more about the final number on an offer sheet, which will almost certainly be higher now than a week ago.

“Price is everything; price drives everything,” said Dietch-Schaefer. “And it’s kind of disheartening to think that they might not be able to get the house that they could’ve gotten last week. Now they really might not be able to get it.”

Dietch-Schaefer has been encouraging her clients not to give up but to adjust.

“Rates are designed to fluctuate; that’s just what they do,” she said. “It’s not a time to be nervous or be concerned that you can’t afford a home; it’s just, What does that home look like that you can afford?”