MICHIGAN — Congressman Bill Huizenga is introducing a new piece of legislation that would give first responders and medical professionals a temporary break on their federal income taxes.

Rep. Huizenga is planning to submit the “HEROES Act" Friday, April 3rd with the hopes of getting it passed as quickly as possible.

Rep. Huizenga tells FOX17, these workers are fighting a war right now and this bill is modeled after guidelines that apply to our military members serving in combat zones, exempting them from paying federal income taxes.

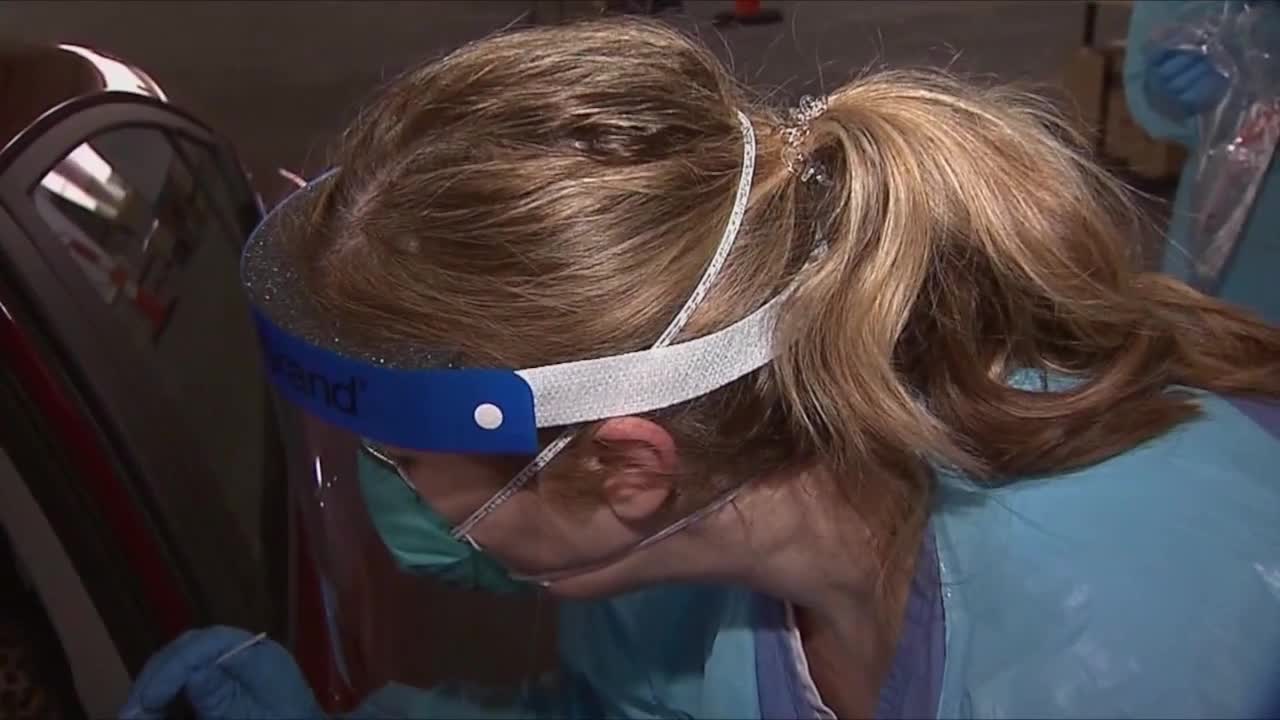

If passed, the HEROES Act would provide a four-month federal income tax break to doctors, nurses, physician’s assistants, nurse practitioners, hospital support staff, EMT's paramedics, firefighters, law enforcement, corrections officers, and hospital custodial staff.

This would apply to any county in the U.S. with at least one case of COVID-19 during this pandemic.

The four-month period spans from February 15th to June 15th.

Rep. Huizenga said everyone in these roles are taking this crisis head-on and deserve a bit of a break.

“They're putting in unbelievable amounts of hours, they don’t always know what the situation is that they're walking into, other than they know it’s gotten more dangerous, not only for them, but for their families and their loved ones. They’re appreciative of this small way of saying 'thank you.' We think they deserve it and hopefully we'll be able to get some action on this pretty quickly,” he said.

Rep. Huizenga said the goal is to get the bill passed as soon as their session picks back up on April 20th, adding that different lawmakers are tossing around the idea of a similar bill at the state level as well.