GRAND RAPIDS, Mich. — As COVID restrictions lift across the country, more families will be planning vacations to get away.

Some of them will be heading outside of Michigan or even the country.

We had a lot of emails into the FOX 17 Problem Solvers last year where passengers weren’t given a refund on flights or hotels that they booked because of COVID.

If you’re planning to leave the country, purchasing travel insurance may help alleviate any future stress especially if you get sick.

Goose Insurance launched with a mobile app from Canada in 2018.

“Unfortunately, in the U.S. we typically buy travel insurance that’s related to trip cancellation and trip interruption. But the most expensive component if you do get sick is travel medical insurance,” said Goose Insurance co-founder Omar Kaywan.

That’s why his company offers COVID-19 insurance and out-of-state and out-of-country medical insurance.

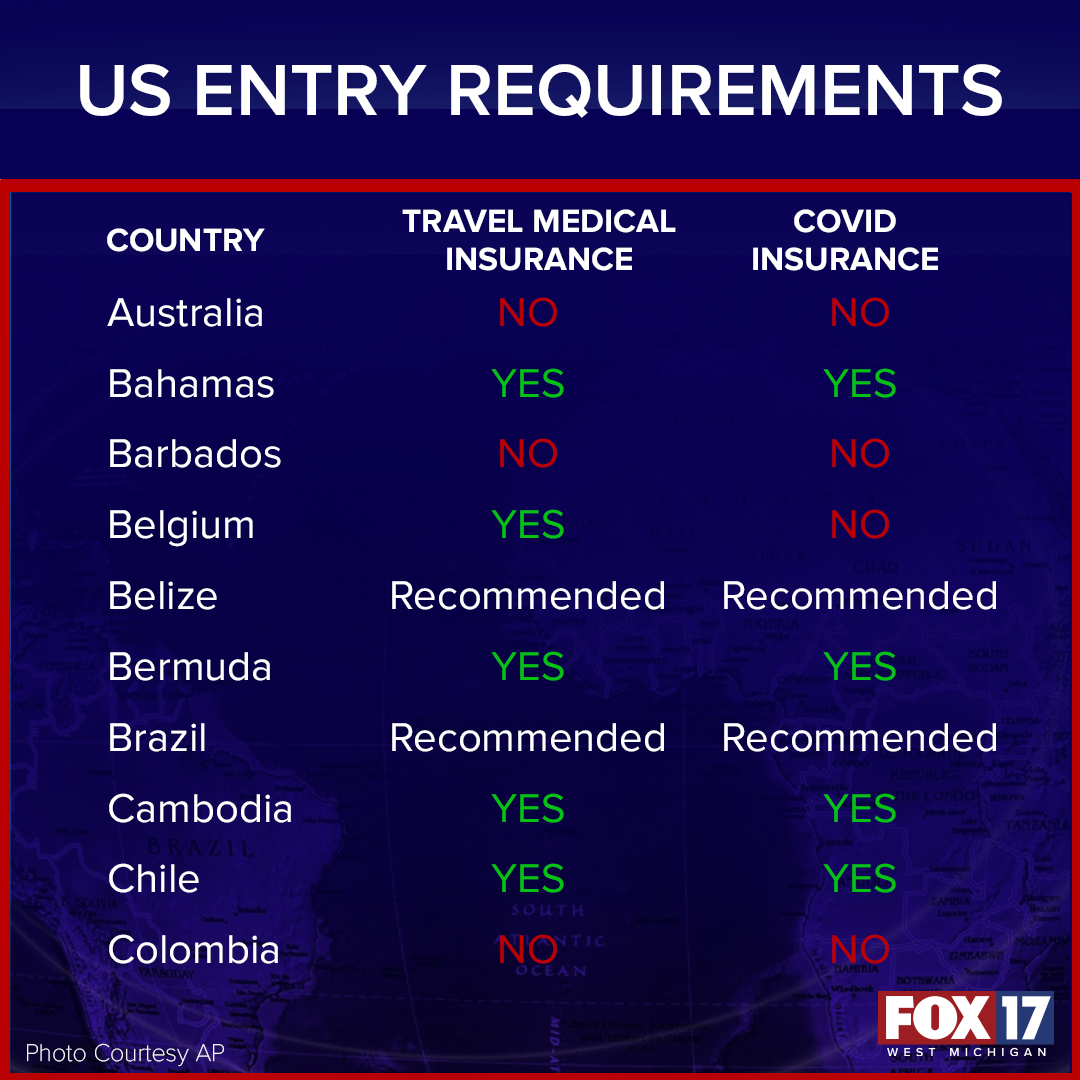

They’re both required in some countries like the Bahamas, Costa Rica and Bermuda even if you’re visiting for a couple days.

It’s not required right now for Mexico but still recommended.

“They are financially liable and it could be as simple as taking a day trip to Mexico or when the borders open up coming up to Canada, you are still liable for travel medical,” said Kaywan.

Some countries even require you to have COVID-19 insurance which would cover your emergency medical care and even has some quarantine benefits.

“So, for example if you’re going to the Caribbean countries right now and if you do contract COVID-19 and you have to quarantine, this policy will cover you for your hotel stay, for meals and accommodation and so on and so forth,” said Kaywan.

A typical hospital stay outside your home state or country could cost thousands. If you’re in the hospital for a few days or longer, those bills pile up fast.

“They’re requiring many visitors from many parts of the world to actually have adequate travel medical insurance,” said Kaywan, “so this is for all international travelers.”

As quarantines get lifted countries are making sure that visitors don’t become a burden to their medical system. You never know when an accident may happen or when your trip may be cut short.

“And it’s really important because most U.S. residents don’t actually know that their extended medical plan, Medicare, Medicaid, whatever plan they’re on may not cover them when they’re traveling outside the US,” said Kaywan.

The U.S. government does not provide medical insurance for citizens overseas, nor does it pay medical bills.

That’s why the US Department of State recommends whichever company you go with, the policy fits your needs.

With Goose Insurance you’re not required to have a physical. You can get $250,000 in coverage in the U.S. and up to $5 million if you’re traveling to another country.

“We’ve all sort of been on this lockdown for a very long time and looking forward to travel, is that we look at this new emergency travel medical aspect of things that are becoming much more of a requirement,” said Kaywan.

Goose Insurance is just one of several companies out there offering this insurance, so do your own homework and choose a plan that fits best for your needs and budget.