KENT COUNTY, Mich. — Michigan residents are still waiting for Governor Gretchen Whitmer to sign the state budget. She has shown her support to sign, and the government is currently running on an extension that lasts until Wednesday.

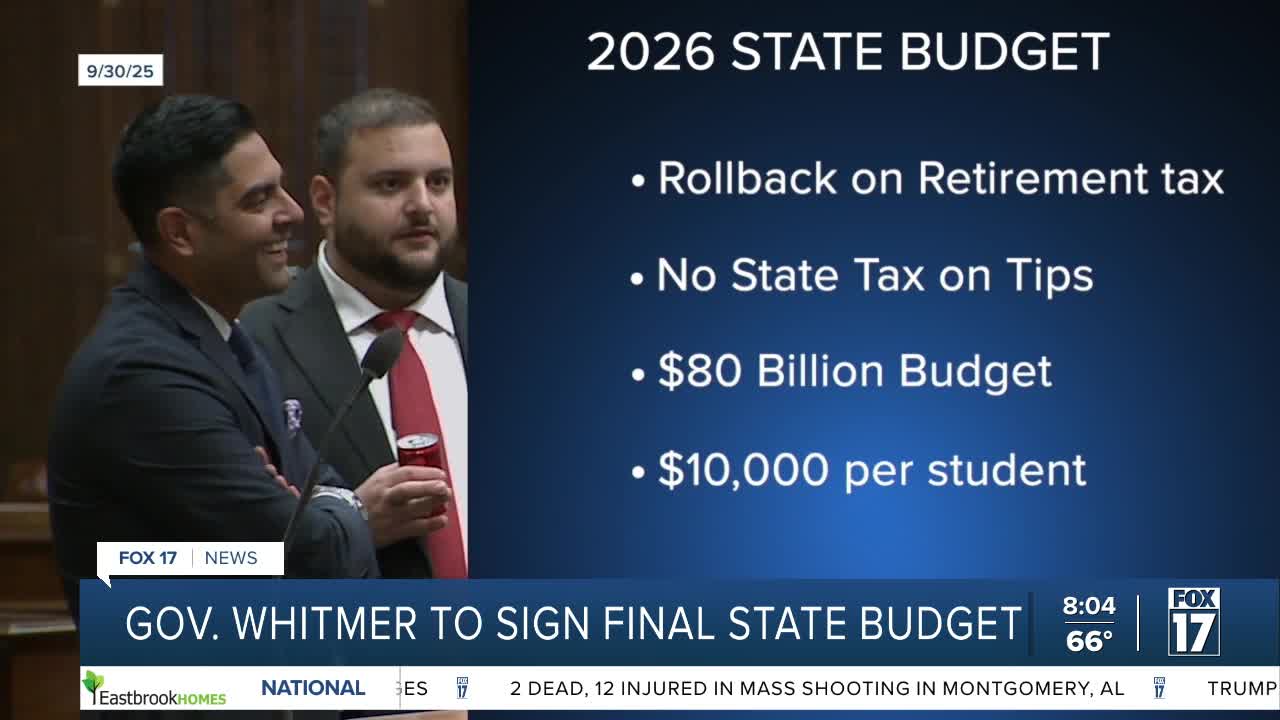

But we are now getting a closer look at what's part of the $80 billion deal.

Road construction is a big chunk of this year's budget, around $1 billion this year and increasing to $1.8 billion by 2030.

When it comes to taxes, we're seeing some cuts like rolling back retirement tax and ending taxes on social security. There will be no state taxes on tips or overtime pay.

State lawmakers last week passed the state funding and school aid packages. They call for more money into schools. This year's budget includes $10,000 per student. The plan also keeps funding for free breakfast and lunch programs.

In a statement released on Sunday, Whitmer says this is the seventh consecutive year that the state has delivered record school funding.

Year after year, we're raising the bar for Michigan kids!

— Governor Gretchen Whitmer (@GovWhitmer) October 5, 2025

⁰For the 7th year in a row, we've delivered record school funding. We're making sure teachers have the resources to teach, parents know their kids are supported, and students have the opportunities they need to thrive. pic.twitter.com/cdE93xqpeo

"I've also been working hard to support literacy in our state by signing common-sense bills to help kids learn how to read and write, and increasing literacy coaches in our schools. This year's budget builds on this work by investing more to help kids read and write," Whitmer said on 'X'.

In a bipartisan agreement, state lawmakers included raising the taxes on marijuana by 24%. This will apply to the wholesale tax. Lawmakers say this will generate $420 million.

They say this money is intended for road improvements. Marijuana has become a large industry here in Michigan.

In 2018, Michigan voters passed a constitutional amendment to legalize medical and adult use. Then, 6 years later, our state surpassed California as the top cannabis market in sales volume.

Cannabis already has a 10% excise tax and the general 6% retail tax. State Representative Bradley Slagh explains that he anticipates this tax to be passed on to consumers.

"What we're ending up with right now is about $1.8 billion, but the agreement was we need 3 to 3 and a half billion every year. So we're definitely not there. This is a movement in a direction to try and help us get to those local roads," Slagh said.

WATCH: State lawmaker supports new tax on pot

This tax increase will take effect at the beginning of 2026.

This story was reported on-air by a journalist and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy.

Follow FOX 17: Facebook - X (formerly Twitter) - Instagram - YouTube