(WXYZ) — Governor Gretchen Whitmer's Office presented the final budget proposal of her tenure in office on Wednesday to state lawmakers.

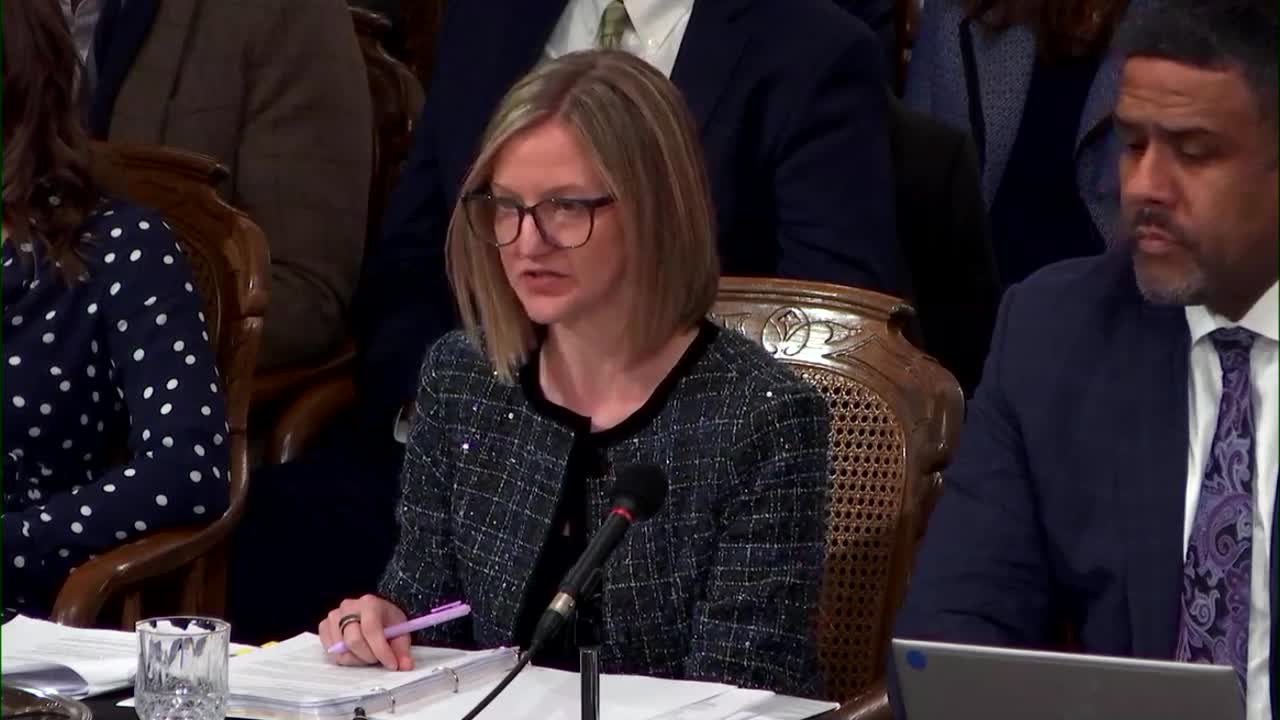

State Budget Director Jen Flood said the budget "lowers costs, protects access to health care, and makes other key investments to help more families live, work, and play in Michigan."

FULL VIDEO: Governor Whitmer's budget recommendations presented to Michigan legislature

“Michigan is open for business and on the move, and this budget will deliver on the kitchen-table issues that make a real difference in people’s lives,” said Whitmer in a news release. “My balanced budget proposal will build on our strong record of bipartisan success. It doubles down on shared, long-term priorities to create good-paying jobs, fix roads, save Michiganders money, and ensure every child can read, eat, and succeed. Let’s work together to deliver another balanced, bipartisan budget on time and keep moving Michigan forward.”

According to the governor's office, the "balanced, fiscally responsible budget recommendation totals $88.1 billion, including a general fund total of $13.6 billion and a school aid budget totaling $21.4 billion. "

Her office also claimed Whitmer's budgets during her 8-year term have allowed Michigan to pay down $28 billion in debt while doubling the "rainy day fund."

This budget proposal provides a tax credit for seniors on their property tax, establishes a "back to school" sales tax holiday, extends the Working Families Tax Credit, continues tax exemptions on tips, overtime, and Social Security, and makes free school meals for Michigan's public school children permanent in Michigan law.

The budget also includes provisions for literacy, expanded free pre-K, expanded after-school programs, tutoring, and adult education. According to the governor's office, the budget includes a 2.5% increase in per-pupil funding

Under the proposal, Michigan would raise $780.4 million to stabilize Medicaid funding through a high tobacco tax rate, as well as a tax on vaping and non-tobacco nicotine products, plus a tax on digital advertising across all platforms, and an updated internet gambling tax structure.

The budget also increases funding to bring the state into compliance with changes made to Medicaid, SNAP, and other federally funded programs implemented under President Donald Trump's One Big Beautiful Bill, otherwise known as H.R. 1.

The budget also includes billions in road funding, as well as millions for job creation programs and workforce development. There is also money set aside for community investment, public safety funding, and veteran and National Guard support, as well as environmental programs and government efficiency.

You can check out the Budget Book below and see more on the State of Michigan's website: